Veteran Impact Challenge Coin

Challenge coins are an integral part of military tradition and culture. These small tokens of appreciation have become symbols of pride and service, serving as constant reminders of the sacrifices made by military members. Academy Asset Management has deep military roots as an authentic, service-disabled veteran-owned asset manager founded by two Navy Officers who were roommates aboard the USS John Paul Jones at the beginning of the post 9/11 conflict in the Middle East. Academy is committed to providing opportunities for veterans by pairing them with Wall Street veterans for mentorship.

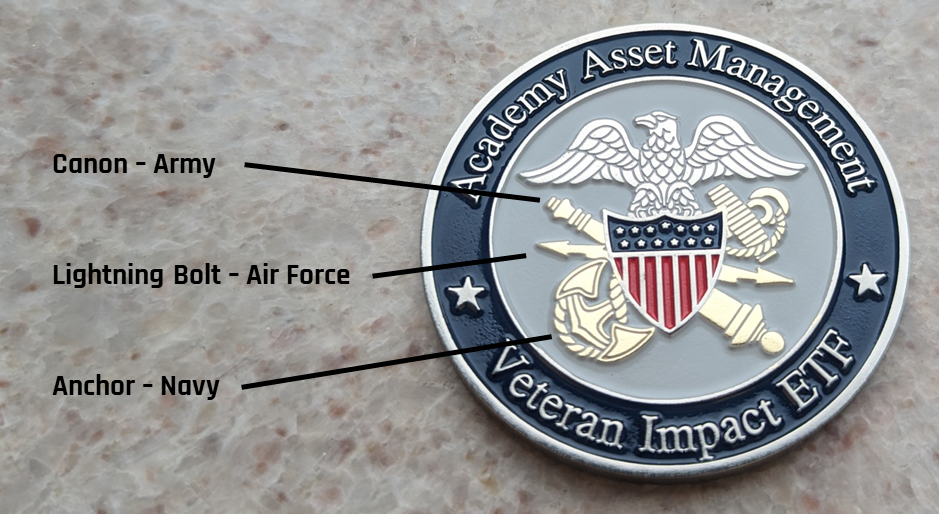

As a homework assignment from a client, Academy was challenged to build a fixed-income strategy that aligns with who we are, and the Veteran Impact Strategy was born. Initially designed for SMA clients, it has now expanded through the Veteran Impact ETF (VETZ). The VETZ challenge coin was minted to celebrate the Academy Veteran Impact ETF, the first publicly traded ETF primarily investing in loans to U.S. service members, military veterans, their survivors, and veteran-owned businesses. The ETF offers market-based returns, government-backed underlying assets, and measurable impact on active-duty service members and veterans. To learn more about the Academy Veteran Impact ETF please visit the website or refer to the fact sheet below.

For more information, please reach out to us below:

Email: info@academyalpha.com

Phone: 773-365-1401